Ready to start your own LLC? This step-by-step guide for entrepreneurs will show you how to start an LLC: a step-by-step guide for entrepreneurs effectively. We’ll cover each critical step, from choosing your business name to filing the required forms, so you can protect your personal assets and enjoy tax benefits. Let’s get started.

Key Takeaways

- Limited Liability Companies (LLCs) provide personal liability protection for owners and offer tax flexibility, allowing profits and losses to be routed through personal tax returns.

- Starting an LLC involves critical steps such as selecting a compliant business name, designating a registered agent, preparing an operating agreement, and filing Articles of Organization.

- Entrepreneurs should be aware of common pitfalls when forming an LLC, including skipping legal formalities and overlooking tax implications, to ensure smooth operations and compliance.

Understanding Limited Liability Companies (LLCs)

Limited liability companies (LLCs) are unique business structures that combine the liability protection of a corporation with the operational flexibility of a partnership. This hybrid nature makes LLCs incredibly appealing to small business owners who want to protect their personal assets while maintaining control over their business operations.

LLCs are legal entities that provide personal liability protection, meaning that the personal assets of LLC members are not at risk if the business incurs debts or legal obligations. This separation of personal and business finances is a cornerstone of why many business owners opt to create an LLC.

Additionally, LLCs offer significant tax benefits, including the option for pass-through taxation, which allows profits and losses to be reported on the owners’ personal tax returns.

What is a Limited Liability Company?

A Limited Liability Company (LLC) is a type of business structure that shields its owners, referred to as members, from being personally liable for the company’s debts or legal obligations. In the event of a lawsuit or financial loss, the personal assets of the members—such as their homes or savings—are typically safeguarded. This protection is a major factor why many entrepreneurs opt to form an LLC.

In addition to liability protection, LLCs enjoy pass-through taxation. Unlike a C corporation, which is taxed at both the corporate and individual levels, an LLC’s profits and losses pass through to the members’ personal tax returns. This avoids the double taxation that corporations face and simplifies the tax process for LLC owners.

Benefits of an LLC

Forming a limited liability company provides numerous benefits that make it an attractive business structure for entrepreneurs. One of the most significant advantages is personal liability protection, which ensures that the personal assets of the LLC members are protected from business liabilities and debts. This separation allows business owners to take risks and grow their businesses without jeopardizing their personal finances.

One significant advantage of forming an LLC is the flexibility it provides in how the business is taxed. LLCs can select a tax classification that suits their specific circumstances, such as being taxed as a sole proprietorship, partnership, or corporation. This adaptability enables LLC owners to optimize their tax strategy, potentially leading to significant savings tailored to the needs of their business.

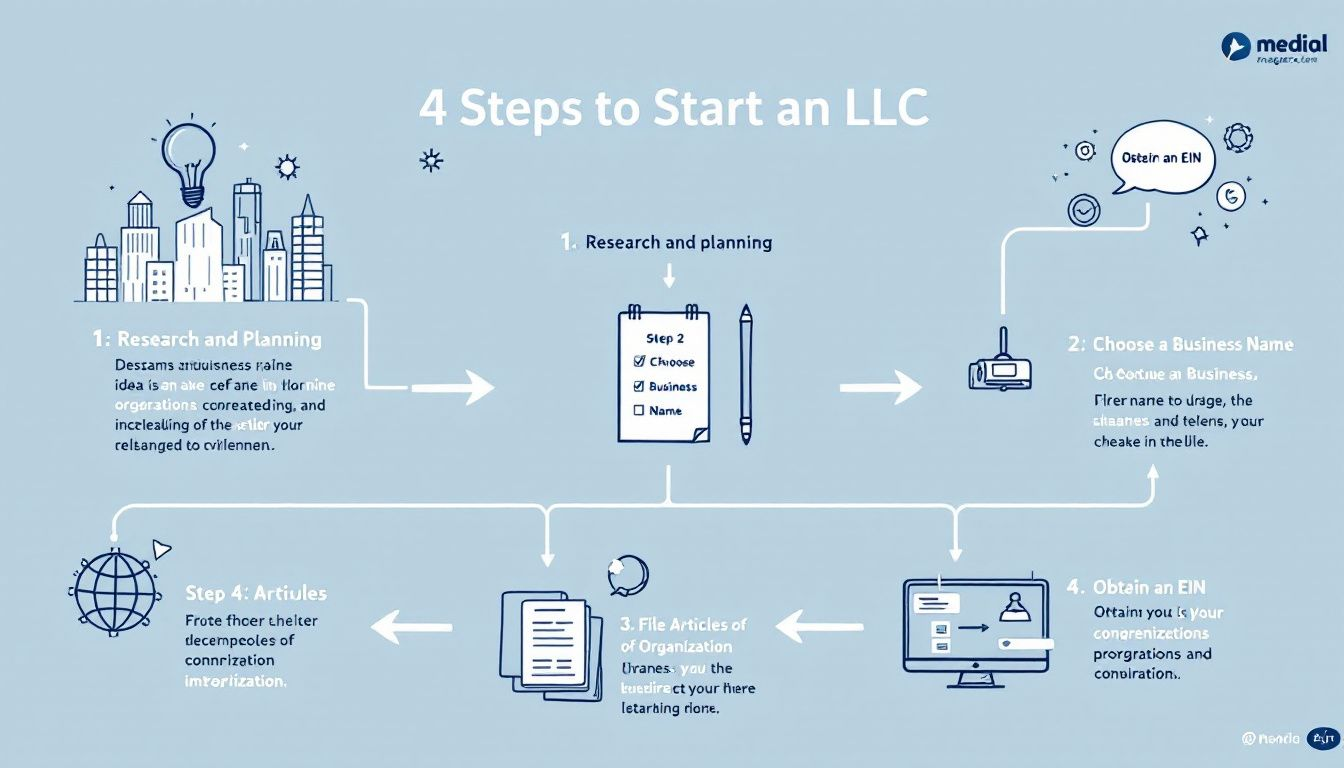

Steps to Start Your LLC

Starting an LLC involves several important steps that ensure your business is legally recognized and properly structured. From choosing a business name to filing the necessary formation documents, each step is crucial to the successful establishment of your LLC. Understanding and following these steps can help you avoid common pitfalls and set your business up for success.

The process begins with selecting a unique and compliant business name, followed by designating a registered agent who will handle legal documents on behalf of the LLC. You’ll then need to determine your LLC’s management structure, prepare an operating agreement, and file the Articles of Organization.

Finally, obtaining an EIN and securing the necessary business licenses and permits are essential steps to ensure your LLC is ready to operate legally.

Choosing a Business Name

Choosing the right business name is a critical first step in starting an LLC. Your business name must comply with state-specific legal requirements, which often include avoiding certain restricted words and ensuring the name is distinguishable from other registered names. Conducting a thorough name search is essential to avoid conflicts with existing businesses and trademarks.

If your desired business name is already taken, try coming up with several alternative options and verify their availability. If you’re not ready to submit your LLC formation paperwork right away, many states allow you to reserve your chosen name for a nominal fee, ensuring it will still be available when you’re prepared to move forward.

Designating a Registered Agent

A registered agent is an essential part of forming and maintaining an LLC. This individual or service is tasked with accepting legal documents and official communications from the government on behalf of your business. You can choose to act as your own registered agent, assign the role to an employee, or hire a professional registered agent service to handle it for you.

Many business owners opt for a registered agent service to ensure that someone is always available during normal business hours to receive important documents. This can be particularly advantageous if you operate in multiple states, as you’ll need a registered agent in each state where your LLC conducts business.

Determining Your LLC’s Management Structure

Choosing the management structure of your LLC is a critical decision that influences the daily operations of your business. You can opt for a member-managed LLC, where all owners are actively involved in managing and making decisions, or a manager-managed LLC, where specific individuals or managers are appointed to oversee operations on behalf of the members.

Choosing the appropriate management structure is important as it impacts the clarity of roles and responsibilities within the LLC. For instance, a member-managed LLC might be ideal for smaller businesses where owners want to be directly involved in day-to-day operations, while a manager-managed LLC might suit larger businesses with more complex operations.

Preparing an LLC Operating Agreement

An LLC operating agreement is a vital legal document that outlines the ownership and operating procedures of the LLC. It is especially important for multi-member LLCs as it helps prevent disputes by clearly defining the roles, responsibilities, and profit-sharing arrangements among members.

Even though not all states require an operating agreement, having one in place is highly recommended. It provides a clear roadmap for how the LLC will be managed and can include provisions for transferring ownership, handling member departures, and resolving disputes.

Consulting a legal professional when drafting the operating agreement ensures that it meets all legal standards and adequately protects the interests of all LLC members.

Filing Articles of Organization

Submitting the Articles of Organization is an essential step in officially creating your LLC as a legal entity. This document usually contains details such as the LLC’s name, its business address, and the names and addresses of the owners. It must be filed with your state’s Secretary of State office, and many states provide the option to file online for added convenience.

The filing fee for the Articles of Organization varies by state, typically ranging from $50 to $200. Some states may also require a publication notice as part of the LLC formation process, so be sure to check your state’s specific requirements to ensure compliance.

Obtaining an EIN and Opening a Business Bank Account

An Employer Identification Number (EIN) serves as a unique identifier for your LLC when dealing with federal taxes. It’s a critical requirement for opening a business bank account, hiring staff, and managing tax obligations. Fortunately, obtaining an EIN is a straightforward process and can be done for free by submitting an application online through the official IRS website.

Setting up a business bank account is an important step in separating your personal and business finances. This separation helps preserve your LLC’s liability protection. Most banks require specific documents to open an account, including your Employer Identification Number (EIN), LLC formation paperwork, and your operating agreement to verify the business structure and ownership details.

Securing Necessary Business Licenses and Permits

The licenses and permits you need to operate your business legally will vary based on your location and industry. Without the proper authorizations, your business could face penalties or legal challenges. To ensure compliance, it’s important to research local regulations or consult relevant industry organizations to identify the specific requirements for your business.

Once you’ve formed your LLC, promptly applying for any required licenses and permits ensures that you can legally conduct business without any interruptions.

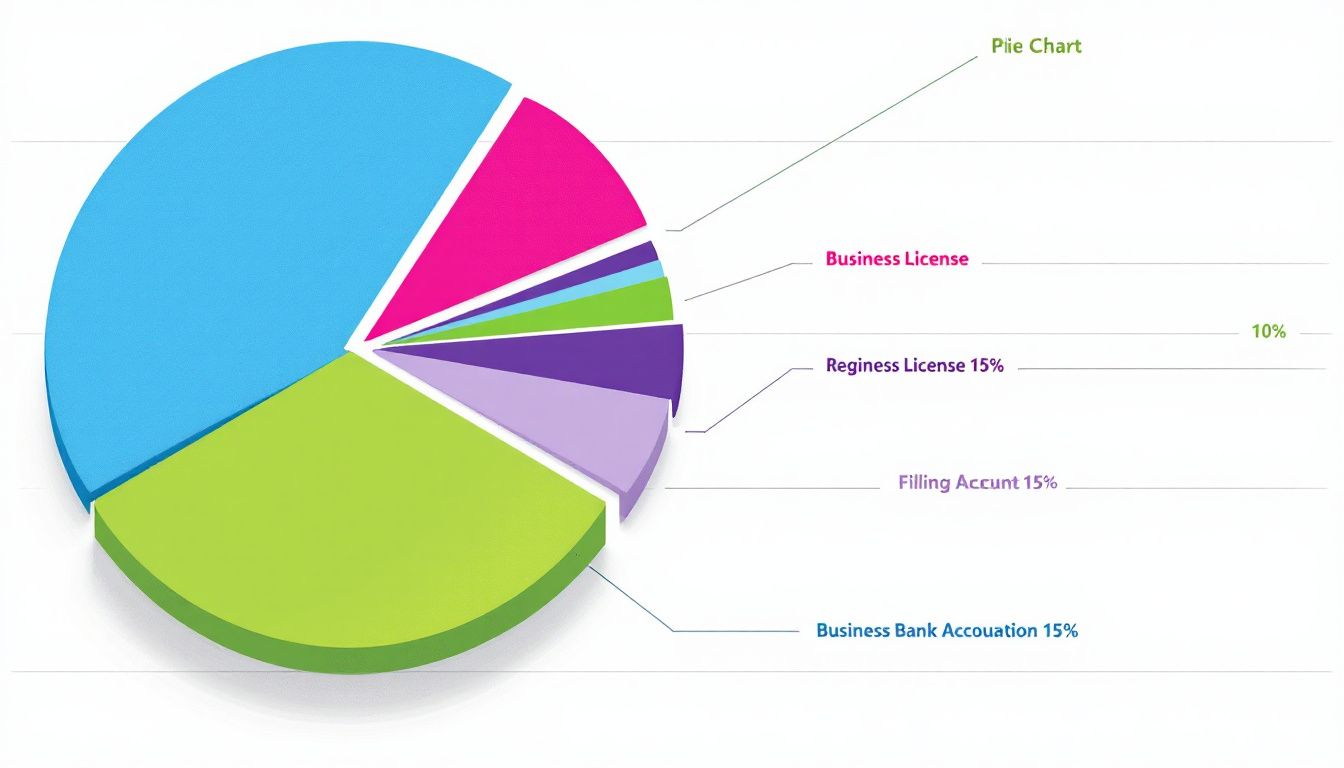

Costs Associated with Starting an LLC

Starting an LLC comes with several expenses, so it’s crucial to plan your budget carefully to prevent unexpected costs. On average, forming an LLC costs about $129, though this amount can vary widely depending on your state and its specific requirements. Being aware of these costs in advance will help you manage your finances more effectively.

There are two main types of costs to consider: initial filing fees and ongoing compliance costs. Initial filing fees are incurred when you first set up your LLC, while ongoing costs are necessary to maintain your LLC’s good standing.

Initial Filing Fees

The initial filing fees for forming an LLC can range from $50 to $500, depending on the state. For example, Montana has the lowest filing fee at $35, while Massachusetts has the highest at $500. Additional costs may include expedited services if you need quicker processing of your formation documents.

Factors influencing the cost of starting an LLC include the state in which you are forming and the specific type of business you are launching. It’s important to research and understand these costs to budget accordingly.

Ongoing Compliance Costs

Maintaining an LLC requires ongoing compliance costs to ensure that your business remains in good standing. These costs include annual report fees, which can range from $25 to $800 depending on the state. Franchise taxes are another ongoing cost that varies by state and business type.

In addition to these state-imposed fees, hiring a service to manage your compliance can add an average cost of $148 on top of the required state fees. These costs are essential for legal compliance and help prevent any lapses that could jeopardize your LLC status.

Common Pitfalls to Avoid When Forming an LLC

Forming an LLC can be a straightforward process, but there are common pitfalls that entrepreneurs should avoid to ensure a smooth formation and operation. Skipping legal formalities and overlooking tax implications are two major mistakes that can lead to significant issues down the line.

Understanding and avoiding these common pitfalls helps maintain compliance and protect your business from potential legal and financial challenges. Next, we’ll delve into specific pitfalls and how to avoid them.

Skipping Legal Formalities

Following all legal obligations is crucial for maintaining your LLC’s protected status. Not adhering to these formalities can lead to fines, legal challenges, and even the dissolution of your LLC. LLCs require more documentation than sole proprietorships, and it’s essential to keep detailed financial records, especially for multi-member LLCs.

Proper record-keeping and maintaining a clear separation between business and personal finances are vital to uphold your liability protection. Not having an operating agreement can cause misunderstandings among LLC members. This lack of clarity can also result in disputes.

Overlooking Tax Implications

Selecting the wrong tax structure for your LLC can result in unexpected tax burdens. Consulting with a tax professional can help you understand the tax implications of your choices and avoid potential penalties. LLCs offer flexibility in tax structures, but it’s crucial to choose the one that best suits your business needs.

Understanding the tax benefits and obligations of your LLC can help you manage your finances more effectively. This includes setting aside money for self-employment taxes to avoid surprise tax bills.

Post-Formation Steps for Your LLC

After forming your LLC, there are several essential steps to ensure your business remains compliant and operational. These steps include getting LLC-specific tax advice, maintaining compliance and good standing, and registering to do business in other states. Following these post-formation steps protects your LLC and ensures its long-term success.

Ensuring your LLC adheres to all legal and regulatory requirements is crucial to avoid personal liability for business debts. Additionally, keeping personal and business finances separate is vital for maintaining your LLC’s limited liability protection.

Getting LLC-Specific Tax Advice

Seeking professional tax advice is crucial for understanding how to effectively manage your LLC’s tax obligations. LLCs have the flexibility to elect their tax structure, including the option to be taxed as corporations to avoid pass-through taxation. Consulting a tax professional can help you navigate the complexities of LLC taxation and choose the best structure for your business.

Understanding the tax implications and benefits of your LLC can prevent costly mistakes and ensure you take full advantage of available tax benefits. This includes setting aside funds for self-employment taxes and understanding your federal and state tax obligations.

Maintaining Compliance and Good Standing

Maintaining ongoing compliance is essential for keeping your LLC in good standing. Regularly reviewing state regulations and updating your operating agreement as needed can help you avoid lapses in compliance. Failure to comply with state regulations can result in losing your LLC’s good standing status, which can have serious legal and financial consequences.

Even though it’s not mandated, keeping an updated operating agreement is advisable. This document can help clarify roles, responsibilities, and procedures, ensuring smooth operations and preventing disputes among LLC members.

Registering to Do Business in Other States

If you plan to expand your LLC into other states, you must file as a foreign LLC in each state where you wish to operate. This involves registering as a foreign entity and following each state’s specific application processes. Failing to register your LLC in another state can lead to hefty fines and penalties, jeopardizing your business’s ability to operate.

A foreign LLC must comply with the regulations of the state in which it operates, including paying federal and state excise taxes depending on the goods sold. Ensuring you follow these requirements can help you avoid legal issues and maintain your LLC’s good standing across multiple states.

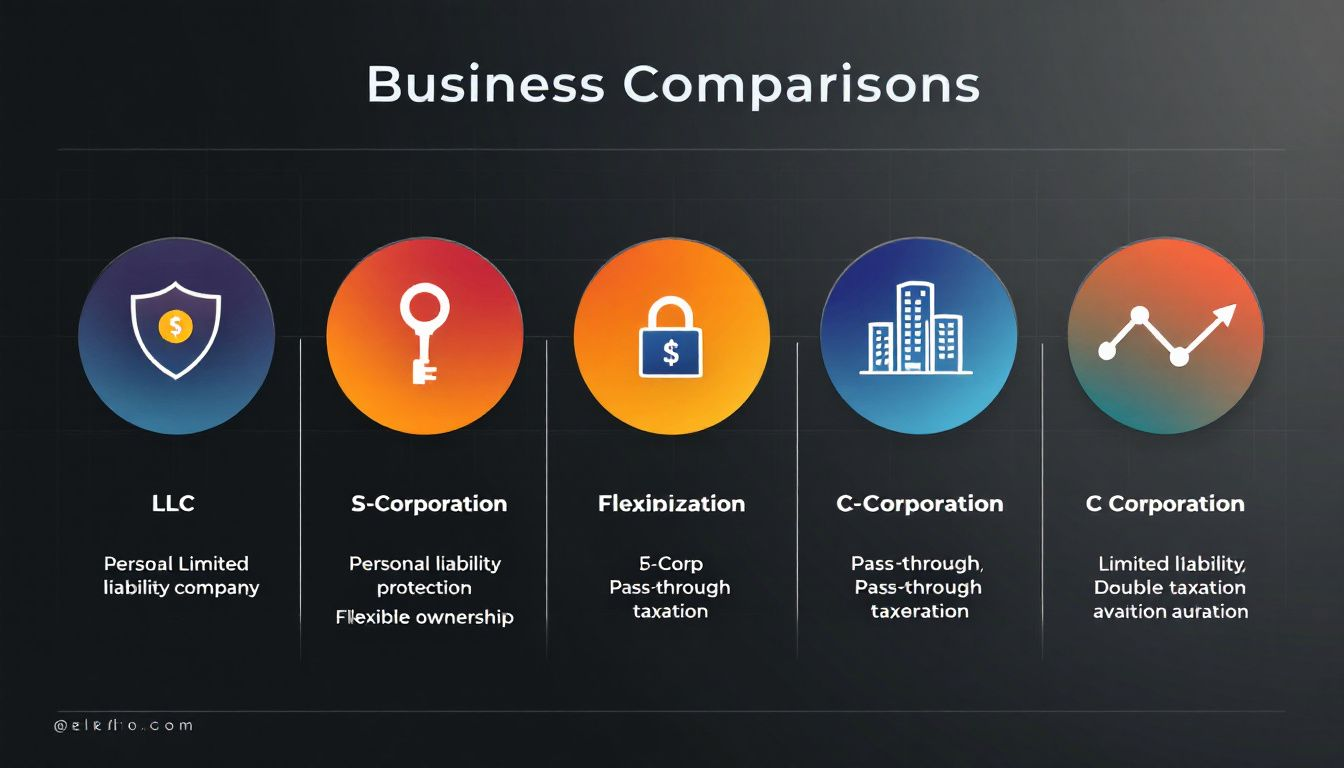

Comparing LLCs with Other Business Structures

When choosing a business structure, it’s essential to compare the advantages and disadvantages of LLCs with other business structures such as sole proprietorships, partnerships, and corporations. Each structure has its own benefits and drawbacks, and understanding these differences can help you make an informed decision.

A sole proprietorship is the simplest business structure, but it does not offer liability protection, exposing the owner’s personal assets to business liabilities. Partnerships can be beneficial for business owners who want to share responsibilities, but general partners have unlimited liability, while limited partners enjoy restricted liability.

Corporations offer the strongest liability protection but face double taxation on profits, which can be a significant drawback. S corporations, on the other hand, allow profits to pass directly to owners’ personal income, avoiding corporate tax. Benefit corporations aim for both profit and public benefit, adding accountability compared to traditional corporations. Nonprofit corporations must reinvest profits into their mission, prohibiting distribution to members.

Choosing the right business structure depends on your specific needs, goals, and risk tolerance. For many entrepreneurs, the flexibility, liability protection, and tax benefits of LLCs make them an ideal choice.

Summary

Starting an LLC is a strategic move that provides personal liability protection, tax flexibility, and operational ease. By following the steps outlined in this guide, from choosing a business name to filing the necessary documents and maintaining compliance, you can set your business up for success. Avoiding common pitfalls and seeking professional advice can further enhance your LLC’s stability and growth.

The decision to form an LLC is a significant one that can impact your business’s future. By understanding the benefits and requirements of an LLC, you can make informed decisions that align with your business goals. Embrace the journey of entrepreneurship with confidence, knowing that you have the right foundation for success.

Frequently Asked Questions

What is a Limited Liability Company (LLC)?

A Limited Liability Company (LLC) is a business structure that offers personal liability protection for its members, safeguarding personal assets from business liabilities. This structure effectively merges the liability protection of a corporation with the operational flexibility found in a partnership.

What are the benefits of forming an LLC?

Forming an LLC provides personal liability protection, tax flexibility, and operational simplicity, and enhances credibility with customers and investors. These advantages make it a sound choice for business owners seeking to safeguard their assets and streamline operations.

What is an operating agreement, and why is it important?

An operating agreement is a critical legal document that defines the ownership structure and operational procedures of an LLC, serving to prevent disputes and clarify member roles and responsibilities. Its importance cannot be overstated, as it establishes a framework for the organization’s governance.

How do I maintain compliance for my LLC?

To maintain compliance for your LLC, regularly review state regulations, ensure your operating agreement is updated, file all necessary reports, and pay required fees or taxes. This diligence is crucial for keeping your LLC in good standing.

Can I expand my LLC to other states?

Yes, you can expand your LLC to other states by registering it as a foreign LLC, which requires adhering to each state’s application processes and paying the necessary fees.

Start Your LLC Today with LegalCrystal!

Simplify your LLC formation process with ease. Watch our step-by-step guide on YouTube to see how simple it is to get started!